fcMiles app for iPhone and iPad

Developer: BeekApps.com

First release : 01 May 2011

App size: 36.34 Mb

fcMiles is a car kilometer registration app designed for the Dutch Tax system. With fcMiles you can create a balanced kilometer log to prove that you do not drive more than 500 private kilometers in your company car.

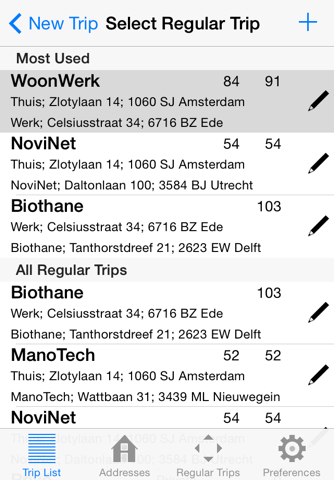

fcMiles is a very complete and efficient App. Regular trips can be registered in ONLY FOUR TAPS.

Trips are synchronized with a web-based database. You DO NOT have to pay an additional fee for this, like with other similar apps. It is even possible to synchronize the administration on two or more iPhones, in case the car is used by more than one person.

For more information about this program visit fcMiles.nl.

Features:

* Handy trip list makes it easy to add AND edit your trips.

* Multiple cars with separate trip lists.

* Administration can be shared on multiple iPhones

* Automatic synchronization with web-based database after every trip and at program startup (can be enabled or disabled).

* Create and edit addresses quick and easy.

* Easy to import addresses from your iPhone Contacts.

* Regular trips make it possible to enter daily trips like home-work quickly. Travel distance, addresses and optional alternate route only has to be registered once and can be copied automatically to a new trip.

* With regular trips you can specify both outbound and return trips. This way, you only have to select the regular trip when you arrive at home and fcMiles will add two trips (to work and back) as required by the tax service.

* Alternate route and private detour kilometers can be easily entered with a trip and also with regular trips.

* A monthly or yearly tax kilometer log report can be requested right from your iPhone. You donít have to log on to a website. It will be mailed as a PDF document to you (or your accountant if you wish). You can print it from your iPhone or from any computer with a PDF or Adobe reader.